Cotisation Foncière des Entreprises (CFE) Business Property Tax

If you have a business in France, you are concerned by the business property tax (CFE). Here is some information to better understand this tax.

What is the CFE tax and who is concerned?

CFE is a local tax. It is based on the rental value of the property the business is registered at (year N-2). It is due by all companies (SARL, EURL, SAS, SCI, etc.) or persons exercising a non-salaried professional activity (Entrepreneurs Individuels including micro entrepreneurs) who were in activity on 1st of January of the current year.

Letting property can also imply being subject to this tax.

- Furnished rental (LMNP, LMP, etc.), except when part of the owner’s home or if the turnover is below5 000 €.

- Unfurnished rentals : if not residential and turnover above 100 000 € HT.

There are exceptions: the first year of activity is exempt from CFE. Individual Entrepreneurs are automatically exempted if their turnover is below 5 000€ the previous year. Some exemptions are permanent and are automatic and others are temporary and have to be applied for.

Registering for the CFE tax

You must submit your CFE declaration form before the 1st of January of the year following your business set-up. Once you have declared your business for CFE you will not have to complete a form each year, unlike tax returns. Only if there is a change in your situation (address, surface area, etc.) or if you are closing your business down will you have to submit this form before the second working day following the 1st of May.

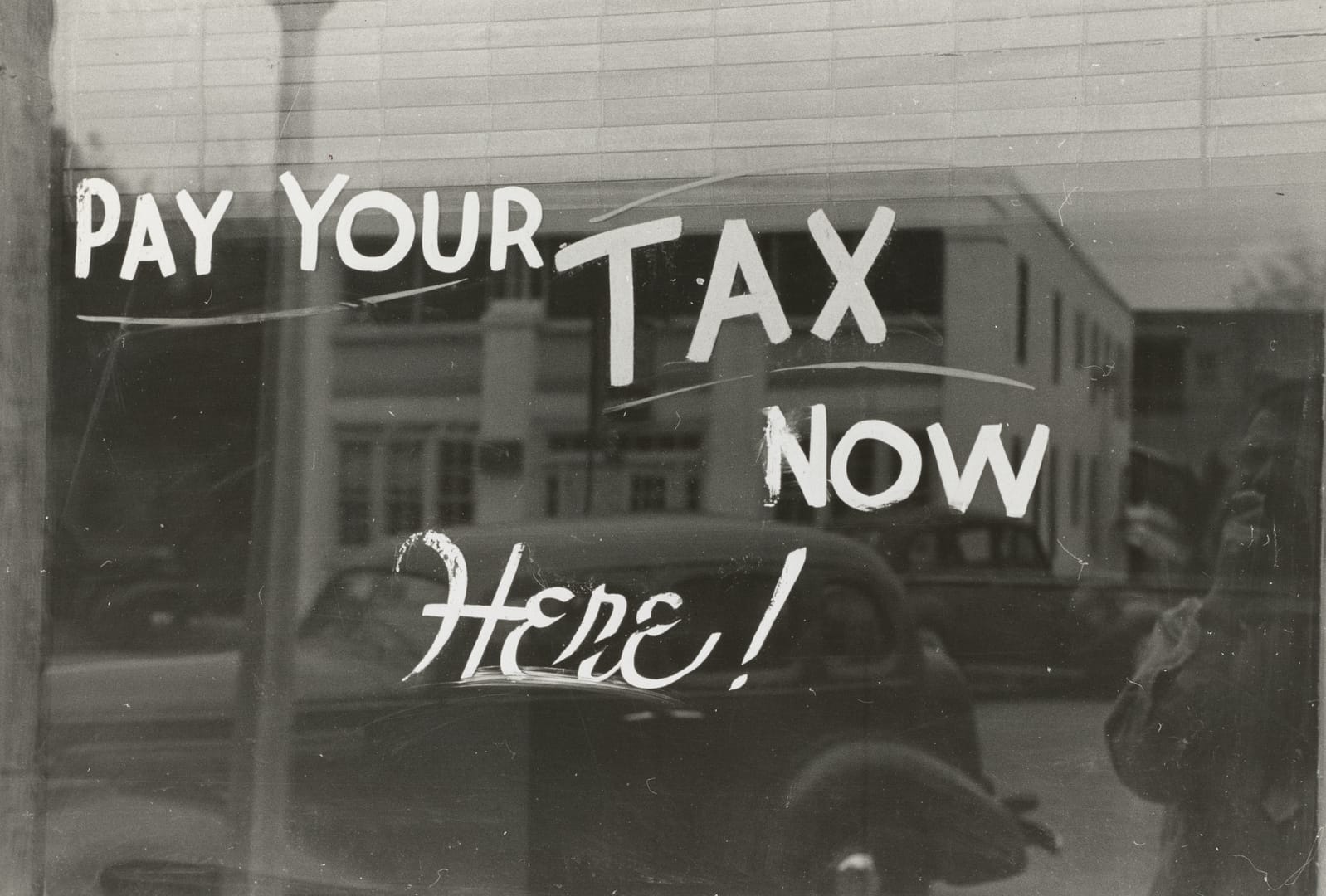

Amount and payment of the CFE tax

The amount of the CFE varies depending on location (local tax) and the value of the property 2 years before the current tax year (for example, for 2023 the tax will be calculated on the year 2021).

You will receive an email indicating your tax notice has been issued. You must connect to your Impôts Professionnel account online to access it. Having a Professional account on the Impôts is mandatory to access your tax notice and pay it. If you do not yet have one, you can create it here or contact us if you need help.

If the amount is less than 3 000 € then the deadline will be the 15th of December of the current year. Provided it exceeds 3 000 € then you should have already paid 50% in June and the other 50% will be due in December.

This tax must be paid by a dematerialized payment method (direct online payment, monthly direct debit or payment by instalment). If you have already set up a direct debit for this tax then it will automatically be paid.

If you feel the amount is very high or if you think you may be exempted, it is always possible to claim a rebate via your Impôts account. You will not always get one but don’t ask, don’t get !

Stay connected for more updates and content by following France Admin’s Facebook page !